Payment Handling: Unterschied zwischen den Versionen

(→FormOfPayment) |

(→CreditCardPaymentType) |

||

| (21 dazwischenliegende Versionen desselben Benutzers werden nicht angezeigt) | |||

| Zeile 21: | Zeile 21: | ||

Finally we will present some xml examples. | Finally we will present some xml examples. | ||

| + | <br /> | ||

| + | <br /> | ||

== Payments == | == Payments == | ||

| Zeile 76: | Zeile 78: | ||

In all other cases the Tour Operator must use "Mixed". The user then can decide per payment which encashment to be used, i.e. it also allows the mix of encashment types. | In all other cases the Tour Operator must use "Mixed". The user then can decide per payment which encashment to be used, i.e. it also allows the mix of encashment types. | ||

| − | + | <br /> | |

| − | + | <br /> | |

| − | + | ||

=== Payment Request === | === Payment Request === | ||

[[Datei:PaymentRequest(Type).jpg|451px|rahmenlos|ohne]] | [[Datei:PaymentRequest(Type).jpg|451px|rahmenlos|ohne]] | ||

| − | + | <br /> | |

| − | + | A payment request indeed is realized as a variant of '''PaymentType'''. To be more precise, a specialization of '''PaymentType''' depending on the chosen ''Form Of Payment'' will be used respectively. | |

| + | <br /> | ||

| + | <br /> | ||

| + | The available specialized payment types are listed in ###. But at first we will look onto the base type. | ||

| + | <br /> | ||

| + | <br /> | ||

==== Available top-level attributes ==== | ==== Available top-level attributes ==== | ||

| Zeile 96: | Zeile 102: | ||

''But notice, that here the attribute is attached to a concrete payment respectively'' | ''But notice, that here the attribute is attached to a concrete payment respectively'' | ||

|} | |} | ||

| − | + | <br /> | |

| − | + | ||

| − | + | ||

==== PaymentScope ==== | ==== PaymentScope ==== | ||

| Zeile 116: | Zeile 120: | ||

So this is also used for marking installments in the case of installment payments | So this is also used for marking installments in the case of installment payments | ||

|} | |} | ||

| − | + | <br /> | |

| − | + | ||

| − | + | ||

==== FormOfPayment ==== | ==== FormOfPayment ==== | ||

In the following the currently supported form of payments are listed, which are mostly self-explanatory. | In the following the currently supported form of payments are listed, which are mostly self-explanatory. | ||

| Zeile 145: | Zeile 147: | ||

|- | |- | ||

| | | | ||

| − | * ''''' | + | * '''''Installment''''' |

|| | || | ||

|- | |- | ||

| Zeile 153: | Zeile 155: | ||

|} | |} | ||

| − | Which of these are supported by the Tour Operator is communicated by him via '''PaymentOptions''' <small>(see [[Payment_Handling#PaymentOptions|chapter]] | + | Which of these are supported by the Tour Operator is communicated by him via '''PaymentOptions''' <small>(see [[Payment_Handling#PaymentOptions|chapter PaymentOptions]], please)</small> |

| − | A ''more detailed look on the supported FOPs can be found in chapter # | + | A ''more detailed look on the supported FOPs can be found in chapter [[Payment_Handling#Specialized payment request types |Specialized payment request types]], '' |

<br /> | <br /> | ||

<br /> | <br /> | ||

| Zeile 166: | Zeile 168: | ||

'''''Just to record it again, all (payment) amount fields are always formed from a decimal value and the ISO currency''''' | '''''Just to record it again, all (payment) amount fields are always formed from a decimal value and the ISO currency''''' | ||

| − | + | <br /> | |

| − | + | <br /> | |

| − | + | ||

==== PaymentServiceProvider ==== | ==== PaymentServiceProvider ==== | ||

| Zeile 177: | Zeile 178: | ||

Beside the name of the Payment/Financial Service Provider and the URL on a logo of the same also a description/explanation can be indicated herewith. | Beside the name of the Payment/Financial Service Provider and the URL on a logo of the same also a description/explanation can be indicated herewith. | ||

| − | + | <br /> | |

| − | + | <br /> | |

| − | + | ||

==== CashHolder ==== | ==== CashHolder ==== | ||

| Zeile 199: | Zeile 199: | ||

''A more detailed description of '''CommonAddressType''' can be found #here#'' | ''A more detailed description of '''CommonAddressType''' can be found #here#'' | ||

|} | |} | ||

| + | <br /> | ||

| + | ==== Specialized payment request types ==== | ||

| + | As mentioned above, all the payment request types listed hereafter are specializations of '''PaymentType'''. So in the following only the respective extensions will be shown and if so explained more in detail. | ||

| + | <br /> | ||

| + | <br /> | ||

| + | ===== InvoicePaymentType ===== | ||

| + | [[Datei:InvoicePaymentType.JPG|509px|rahmenlos]] | ||

| + | |||

| + | <br /> | ||

| + | This is an "empty" specialization of the base '''PaymentType'''. In case of an invoice payment this information is sufficient here because '''InvoiceAddress''' in the '''BookingDetails''' provides the informtion on a possible invoice recipient. If this information should not be present the invoice is to be addressed to the booking owner, which is a mandatory information provided by '''BookingOwnerAddress''' in the '''BookingDetails'''. | ||

| + | <br /> | ||

| + | <br /> | ||

| + | |||

| + | ===== CreditCardPaymentType ===== | ||

| + | [[Datei:CreditCardPaymentType.JPG|533px|rahmenlos]] | ||

| + | |||

| + | <br /> | ||

| + | This is the PaymentType extended with credit card or PCI token information. '''PCIToken''', '''PCITokenIssuer''' and '''PCIBin''' are used when credit card tokenization is involved. | ||

| + | |||

| + | The credit card information shown here is mostly self-explanatory, only the '''CreditCard''' element respectively '''CreditCardType''' needs a more detailed explanation. | ||

| + | |||

| + | [[Datei:CreditCard.JPG|287px|rahmenlos]] | ||

| + | <br /> | ||

| + | <br /> | ||

| + | |||

| + | ===== DirectDebitingPaymentType ===== | ||

| + | [[Datei:DirectDebitPaymentType.JPG|667px|rahmenlos]] | ||

| + | |||

| + | <br /> | ||

| + | |||

| + | ===== EBankingPaymentType ===== | ||

| + | [[Datei:EBankingPaymentType.JPG|670px|rahmenlos]] | ||

| + | |||

| + | <br /> | ||

| + | |||

| + | ===== EWalletPaymentType ===== | ||

| + | [[Datei:EWalletPaymentType.JPG|412px|rahmenlos]] | ||

| + | |||

| + | <br /> | ||

| + | |||

| + | ===== InstallmentPaymentType ===== | ||

| + | [[Datei:InstallmentPaymentType.JPG|653px|rahmenlos]] | ||

| + | |||

| + | <br /> | ||

| + | |||

| + | ===== VoucherPaymentType ===== | ||

| + | [[Datei:VoucherPaymentType.JPG|447px|rahmenlos]] | ||

| + | |||

| + | <br /> | ||

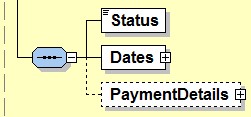

=== Payment Response === | === Payment Response === | ||

| Zeile 211: | Zeile 260: | ||

We don't repeat the information here which is identical with the request part documented above. | We don't repeat the information here which is identical with the request part documented above. | ||

| − | + | <br /> | |

| − | + | <br /> | |

==== Status ==== | ==== Status ==== | ||

The following payment status we are dealing with. | The following payment status we are dealing with. | ||

| Zeile 245: | Zeile 294: | ||

With retrieving a booking one can follow / monitor the payment status. | With retrieving a booking one can follow / monitor the payment status. | ||

| − | + | <br /> | |

| − | + | <br /> | |

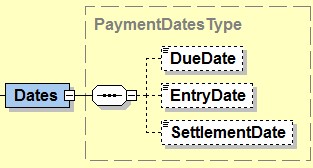

==== Dates ==== | ==== Dates ==== | ||

| Zeile 265: | Zeile 314: | ||

In case of Tour Operator debiting this is the time when payment status changes from "open" to "settled" | In case of Tour Operator debiting this is the time when payment status changes from "open" to "settled" | ||

|} | |} | ||

| − | + | <br /> | |

| − | + | ||

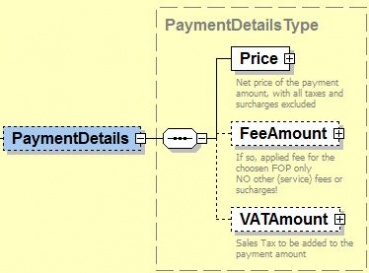

==== PaymentDetails ==== | ==== PaymentDetails ==== | ||

| Zeile 272: | Zeile 320: | ||

This complex is self explanatory. It should only be explicitly pointed out here that the fee amount is only the fee charged in connection with the chosen payment method. | This complex is self explanatory. It should only be explicitly pointed out here that the fee amount is only the fee charged in connection with the chosen payment method. | ||

| + | <br /> | ||

| + | <br /> | ||

== PaymentOptions == | == PaymentOptions == | ||

| Zeile 293: | Zeile 343: | ||

| '''PercentFee'''|| Percentage share of the sales price to be added as surcharge for the chosen FOP to the same | | '''PercentFee'''|| Percentage share of the sales price to be added as surcharge for the chosen FOP to the same | ||

|} | |} | ||

| + | <br /> | ||

== PaymentOverview == | == PaymentOverview == | ||

| + | |||

| + | <br /> | ||

| + | <br /> | ||

== Visualization / Examples == | == Visualization / Examples == | ||

Aktuelle Version vom 11. Juli 2018, 17:05 Uhr

Inhaltsverzeichnis

- 1 General information

- 2 Payments

- 3 PaymentOptions

- 4 PaymentOverview

- 5 Visualization / Examples

General information

The payment handling, provided by Payments elements, allows

- The user to enter payments

- The Tour Operator to inform on expected, desired and effected payments

Additionally there are further "functions" available to the Tour Operator / Organizer and thus within responses only:

- PaymentOptions to inform about the supported Form Of Payment (FOP) and possibly associated fees (surcharges) respectively

- PaymentOverview to present a payment summary at one glance.

So far this all is offered by two messages, the BookingRequest/Response and the dedicated payment message PaymentRequest/Response. For both - and possibly any other messages in the future - this is done the same identical way.

Therefore the following views are performed independently from the underlying message.

At first we focus on Payments, followed by PaymentOptions and PaymentOverview

Finally we will present some xml examples.

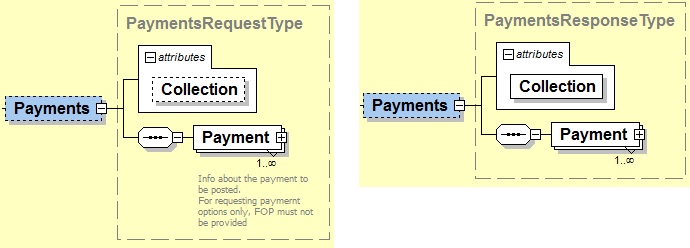

Payments

With a request one might enter one or more payments whereas the responses will inform you on all existing payments (payment positions) of the "booking" at that point in time, independent from the channel these have been entered.

In both - request and response - the underlying basic structure/complex of a concrete payment is from PaymentType, with different characteristics respectively extensions for request and response; but the basic information is always the same.

So PaymentsRequestType/PaymentsResponseType inherits from PaymentType respectively.

Further Payments always signalizes that we are dealing with one or more payments while Payment elements are used for one concrete payment respectively.

In the following we will describe the used request and response structures more in detail. However, we only will show the information that is helpful for a general understanding in the treated context “payment handling”. The complete information on all available elements, attributes, values etc. can be taken from the XSD Documentation.

Another chapter is dedicated to the different Form Of Payment (FOP)

We will start with the description of the @Collection attribute, which substantively is identical for request and response, with the only difference that it is mandatory for the response.

| Attribute | Values / Explanation | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| @Collection | This is used to inform on

Please notice, when entered here this is valid for all payments of the booking as a whole.

|

If a Tour Operator likes to restrict the payments on a specific encashment type he can do it on Payments level; e.g.: To prohibit agency debiting at all he can provide "TourOperator" here, with the consequence that all payments must directly be handled between customer and Tour Operator.

In all other cases the Tour Operator must use "Mixed". The user then can decide per payment which encashment to be used, i.e. it also allows the mix of encashment types.

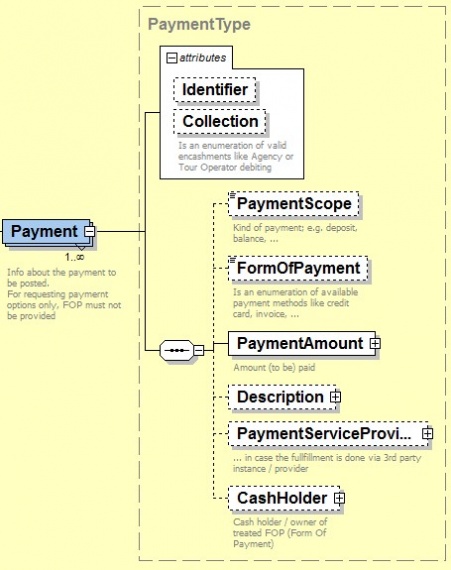

Payment Request

A payment request indeed is realized as a variant of PaymentType. To be more precise, a specialization of PaymentType depending on the chosen Form Of Payment will be used respectively.

The available specialized payment types are listed in ###. But at first we will look onto the base type.

Available top-level attributes

| Attribute | Values / Explanation |

|---|---|

| @Identifier | This is a unique identifier within one message, which can be used to reference on a concrete payment |

| @Collection | Compare with explanations given above, please

But notice, that here the attribute is attached to a concrete payment respectively |

PaymentScope

This describes the purpose of the payment(s); it is an enumeration with the following values

| Value | Explanation |

|---|---|

| Balance | This is used to mark the total price to be paid to the organizer / Tour Operator, less any down payment.

Initially, this amount is specified together with a due date by the organizer / Tour Operator. |

| Deposit | This is used to mark the down payment amount expected by the organizer / Tour Operator, which is initially specified by them together with a due date. |

| Interim | This is used to mark an interim payment with an amount less than the remaining payment amount when the due date for the remaining payment has not yet been reached.

So this is also used for marking installments in the case of installment payments |

FormOfPayment

In the following the currently supported form of payments are listed, which are mostly self-explanatory.

|

|

|

|

|

Account based FOP using the online banking account of an user, like Giropay and Sofortueberweisung |

|

Account based FOP, like PayPal and Paydirect |

|

|

|

|

|

Which of these are supported by the Tour Operator is communicated by him via PaymentOptions (see chapter PaymentOptions, please)

A more detailed look on the supported FOPs can be found in chapter Specialized payment request types,

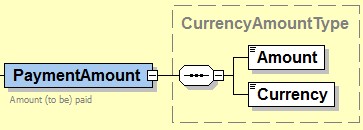

PaymentAmount

Just to record it again, all (payment) amount fields are always formed from a decimal value and the ISO currency

PaymentServiceProvider

This more or less is self-explanatory.

Beside the name of the Payment/Financial Service Provider and the URL on a logo of the same also a description/explanation can be indicated herewith.

CashHolder

The Cash Holder is the "owner" of the treated FOP. He/she is the person who is contacted if something went wrong with the corresponding payment, like exceeded credit limit with a credit card or a failed direct deposit.

The Cash Holder can be a person already involved in the booking, either as traveller and/or as booking owner or another independent person. For all cases we have the possiblity to inform on that person, while avoiding redundancies:

| AssignedToBookingOwner | As there is only one booking owner existing, it is sufficient to flag this by a boolean |

| AssignedToTraveller | As there are one or more traveller in the booking existing, one must enter an according reference here |

| OwnerDetails | To provide name, address and (media) contact details of that person.

A more detailed description of CommonAddressType can be found #here# |

Specialized payment request types

As mentioned above, all the payment request types listed hereafter are specializations of PaymentType. So in the following only the respective extensions will be shown and if so explained more in detail.

InvoicePaymentType

This is an "empty" specialization of the base PaymentType. In case of an invoice payment this information is sufficient here because InvoiceAddress in the BookingDetails provides the informtion on a possible invoice recipient. If this information should not be present the invoice is to be addressed to the booking owner, which is a mandatory information provided by BookingOwnerAddress in the BookingDetails.

CreditCardPaymentType

This is the PaymentType extended with credit card or PCI token information. PCIToken, PCITokenIssuer and PCIBin are used when credit card tokenization is involved.

The credit card information shown here is mostly self-explanatory, only the CreditCard element respectively CreditCardType needs a more detailed explanation.

DirectDebitingPaymentType

EBankingPaymentType

EWalletPaymentType

InstallmentPaymentType

VoucherPaymentType

Payment Response

As extension of the request we here have the following additional information

Here we describe only the newly added or changed elements in comparison to the request

We don't repeat the information here which is identical with the request part documented above.

Status

The following payment status we are dealing with.

| Status | Explanation |

|---|---|

| Open | This is the initial status when a payment (wish) by the Tour Operator (TO) has been announced respectively requested.

Normally the TO informs about the requested deposit and balance payments |

| Recorded | This is the status, when the payment was entered in the travel agency, which only can be the case with agency debiting.

From customer point of view this is a relevant status, as the payment is done or at least triggered then; the regarding amount immediately appears as "paid" |

| Settled | From TO view respectively its bookkeeping this is the most important status as it means that the TO received the money |

| Failed | This means that a payment failed.

The Tour Operator or the Agency will have to clarify the according payment with the designated Cash Holder of the regarding payment |

| Confirmed | ??? |

The normal "status flow" will be

- In case of Agency debiting: Open => Recorded => Settled

- In case of Tour Operator debiting: Open => Settled

With retrieving a booking one can follow / monitor the payment status.

Dates

The Dates elemets are more or less self-explanatory.

| DueDate | The date on which the requested payment (e.g. deposit or balance) is expected by the Tour Operator |

| EntryDate | The date on which the payment has been entered by the Travel Agency.

At that time the status of the payment status changes from "open" to "recorded" |

| SettlementDate | The actual date of receipt of payment by the tour operator.

In case of Tour Operator debiting this is the time when payment status changes from "open" to "settled" |

PaymentDetails

This complex is self explanatory. It should only be explicitly pointed out here that the fee amount is only the fee charged in connection with the chosen payment method.

PaymentOptions

With PaymentOptions the Tour Operator can inform on the supported payment options in case of a Tour Operator collection.

Indeed one PaymentOption is used per accepted FormOfPayment.

For agency debiting there must exist an agreement between TO and the agency which defines the payment processing, but this is out of scope here.

In the following only the elements are explained which appears here for the first time.

| FixedFee | Total amount of the surcharge for the chosen FOP, to be added to the sales price |

| PercentFee | Percentage share of the sales price to be added as surcharge for the chosen FOP to the same |

PaymentOverview

Visualization / Examples

So we might follow the following workflow:

1. Pricing request / quote This will display the expected payments with a status "open" which at least is the total payable amount of the booking. In that case the

2. Book Within the request you can enter one or more payments With the according response one will receive back the correspondign status from Tour Operator perspective

3. Retrieve / display the booking Herewith you will receive back respectively the latest status of the (entered) payments at that time